Are you planning to purchase a house (or an apartment) in Noida or Delhi NCR? No matter if you are buying to keep it for yourself or planning to rent it out in the long run, you would like to know one thing: what will be your actual monetary return? That’s counted for pretty much every scenario, but especially when you’re evaluating rental yield in Noida / rental yield in Delhi NCR for your investment.

To put it simply, rental yield is the percentage of the total amount that one receives annually (as rent) in proportion to the price of the property.

How Rental Yield is Calculated

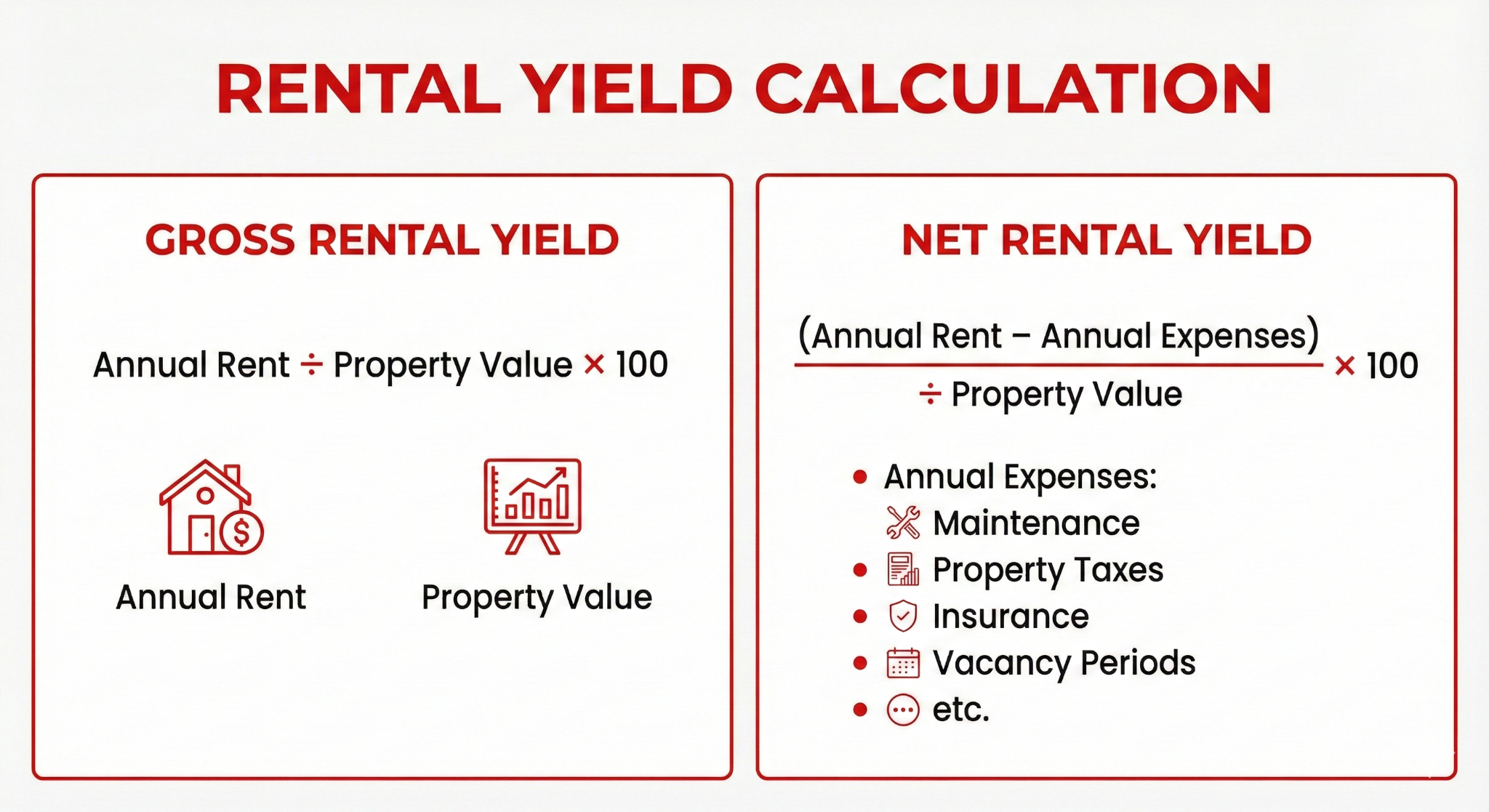

Most rental yield calculators and financial websites targeting Indian property adventurers rely on two core metrics: gross yield and net yield.

- Gross Rental Yield is calculated by dividing the annual rent by the property value and then multiplying the result by 100 to get the percentage value.

- Net Rental Yield = (Annual Rent – Annual Expenses) ÷ Property Value × 100. Expenses may be maintenance, property taxes, insurance, vacancy periods, and so on.

Gross yield shows the situation briefly and approximately.

Net yield reflects the real situation, also considering further costs.

Sample calculation:

| Property Value | Monthly Rent | Annual Rent | Estimated Annual Expenses | Net Income | Net Rental Yield |

|---|---|---|---|---|---|

| ₹70,00,000 | ₹21,000 | ₹2,52,000 | ₹30,000 | ₹2,22,000 | (2,22,000 ÷ 70,00,000) × 100 = 3.17% |

From this, we can calculate your gross yield as follows:

Gross yield = (₹2,52,000 ÷ ₹70,00,000) × 100 ≈ 3.6%

Net Yield (after expenses) = 3.17%

That gives you a good way to double-check your work before you invest.

What’s a Realistic Rental Yield in Noida / Delhi NCR

While browsing for properties in Neotown or the Delhi NCR area, it is always beneficial to compare the rental yield in Noida / rental yield in Delhi NCR with the actual market data.

- Residential yields in the various areas of the Delhi-NCR region mostly vary from 2% to 6%, which is greatly influenced by the locality, demand for the property, and the kind of property.

- In the case of Noida, a rental return which would be considered “healthy” is usually around 3% to 5%, that is, if the property has been priced appropriately and there is a steady flow of tenants.

- Moreover, in some areas (such as those with good transport links and increased demand), rental yields can be at the upper level, particularly if the owners keep the costs under control.

In other words, if you find a good unit at Neotown and take good care of the expenses, your rental yield will indeed be attractive over the medium-to-long term.

Why Using a Rental Yield Calculator via Neotown Makes Sense

- Transparent expectations: Instead of just guessing the rent that you might get, you can come up with a concrete yield by using market-realistic rent and cost data.

- Unit comparisons: Let’s imagine that you want to decide between buying a 2-BHK or a 3-BHK. You can calculate both of their rental yields with the help of the calculator and see which one offers a better rental yield.

- Understand cash flow and long-term growth: Rental yield only speaks of the rental income potential. However, combined returns could be even better since properties generally tend to appreciate over time (especially in growing urban areas in Delhi NCR).

Quick Rental Yield Comparison: Delhi, Noida, Delhi NCR

| Region/ City | Average Rental Yield |

|---|---|

| Delhi (urban areas) | ~2% – 4% |

| Noida | ~3% – 5% (sometimes up to ~6%) |

| Overall Delhi NCR | Varies 2% – 6% depending on locality & demand |

How You Can Use This for a Neotown Investment

Here’s how you can make a smart investment decision at Neotown, evaluating rental yield in Noida / rental yield in Delhi NCR:

- Select a unit you plan to purchase (2/3/4 BHK—what unit fits your budget?).

- Calculate tentative rent by comparing similar flats nearby, demand, and locality.

- Put down the property cost and estimated expenses (maintenance, taxes, etc.) into a rental yield calculator.

- See what your net rental yield and gross yield come out to. If the yield is 3–5% (or higher), that is a good indication in the case of Noida / Delhi NCR.

- Also, consider the future appreciation — high rental yield + increasing property value = more long-term ROI.

The bottom line is that a rental yield calculator allows you to separate emotion from numbers. And when you decide on Neotown, you are choosing a well‑planned option — which makes the numbers more predictable.

FAQs

Q1. What is considered a “good” rental yield in Noida / rental yield in Delhi NCR?

Around 3% to 5% (net yield) of rental yield is considered good for residential properties in most areas of Noida and Delhi NCR, taking into account property rates and local rental demand.

Q2. Should I rely only on rental yield before buying a flat?

No — rental yield is a very useful metric, but not the only one. You must also consider expenses (maintenance, taxes), vacancy risk, likely appreciation of property value over time, and demand in the area.

Q3. Can the yield change over time?

Yes — rental yield always varies due to rent increases, property value changes, maintenance costs, and how well your apartment is rented. Regular rent reviews and good housekeeping can help keep the yield healthy.

Contact Us

📧 Email: info@theneotown.com

🌐 Website: www.theneotown.com

Also Read: Why Homebuyers Prefer the NeoTown Flats at Noida Extension for a Better Lifestyle?